Standard Variable Overhead for Actual Units Produced

60000 hours The variable factory overhead controllable variance is a. Actual production was 11700 units.

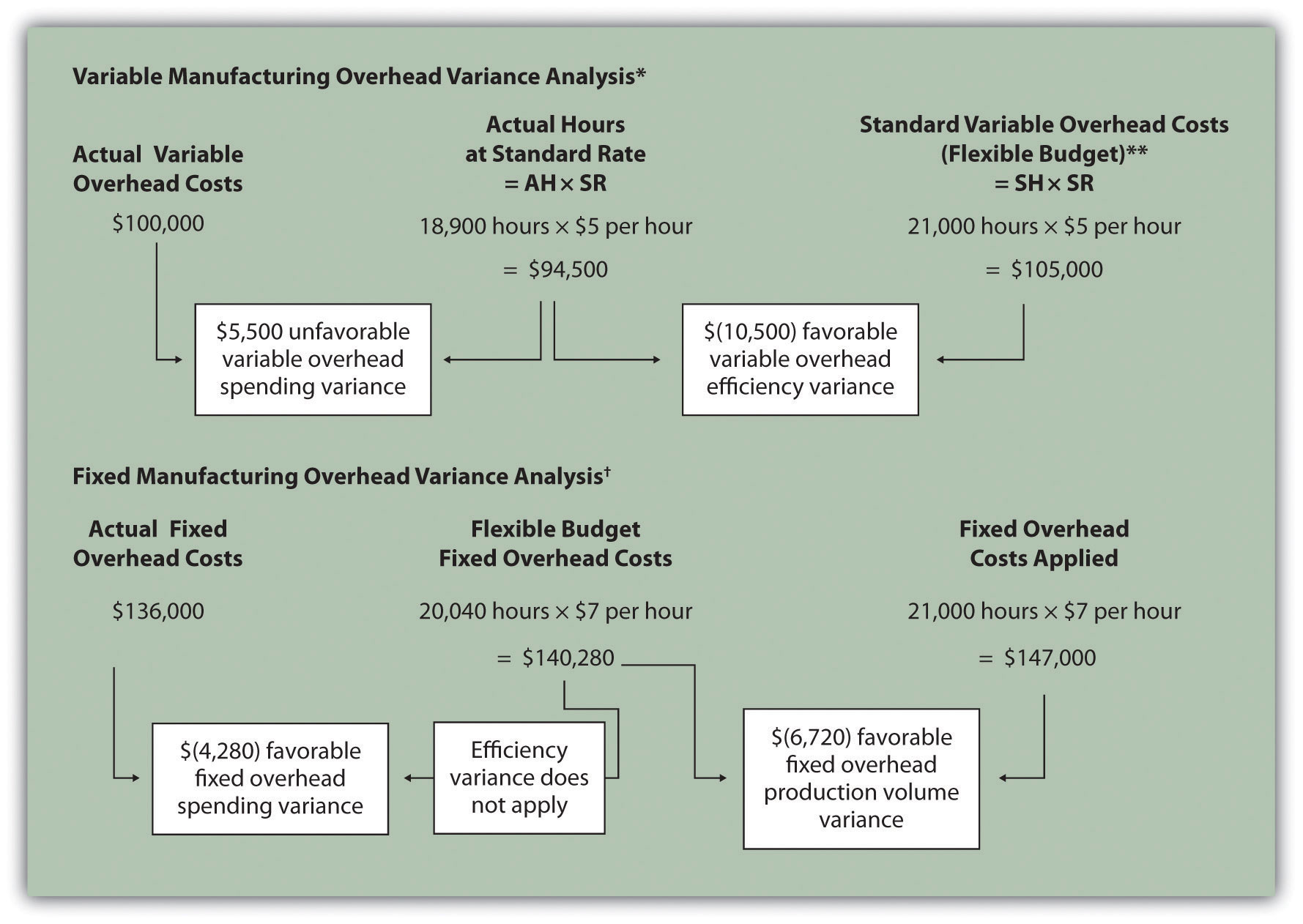

Variable Manufacturing Overhead Variance Analysis Accounting For Managers

The standard hours for production were 5 hours per unit.

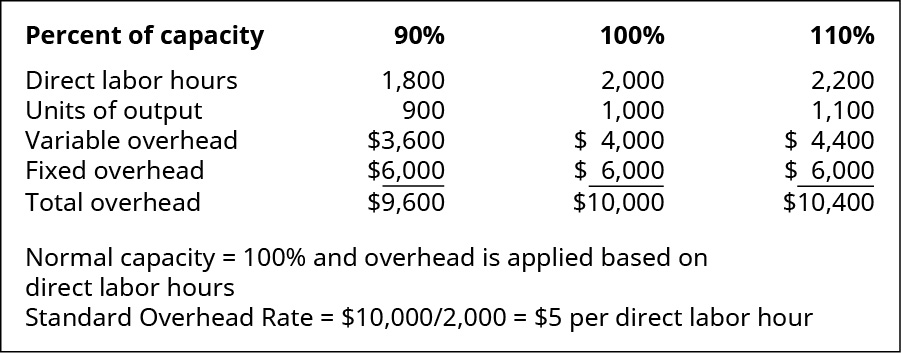

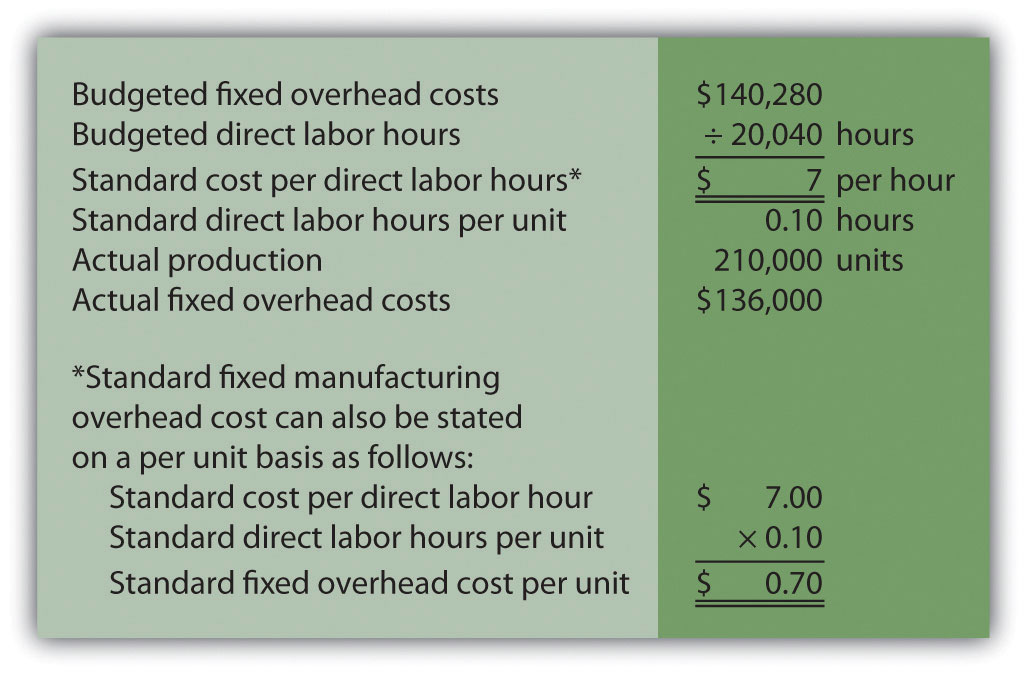

. Direct labor hours per unit 220 Variable overhead per hour 250 Fixed overhead per hour based on 11990 DLHs 300 Actual. Standard Hours for 100 of normal Capacity - Standard Hours for Actual Units Produced x Fixed Factory Overhead Rate. 10000 Standard variable overhead rate.

However the actual output is 4000 units and the actual variable overheads are 3000. Fixed overhead per DLH based on 8900 DLHs 1. Compute all the appropriate variances using the two-variance approach.

Standard Actual Variable overhead rate335 Fixed overhead rate180 Hours18900 17955 Fixed overhead46000 Actual variable overhead 67430 Total factory overhead 101450 Actual hours are equal to standard hours for units produced. Standard Costs Fixed overhead based on 10000 hours 3 hours per unit 080 per hour Variable overhead 3 hours per unit 200 per hour Actual Costs Total variable cost 18000 Total fixed cost 8000. Total overhead was budgeted at 900000 for the year and the budgeted fixed overhead rate was 3 per unit of output.

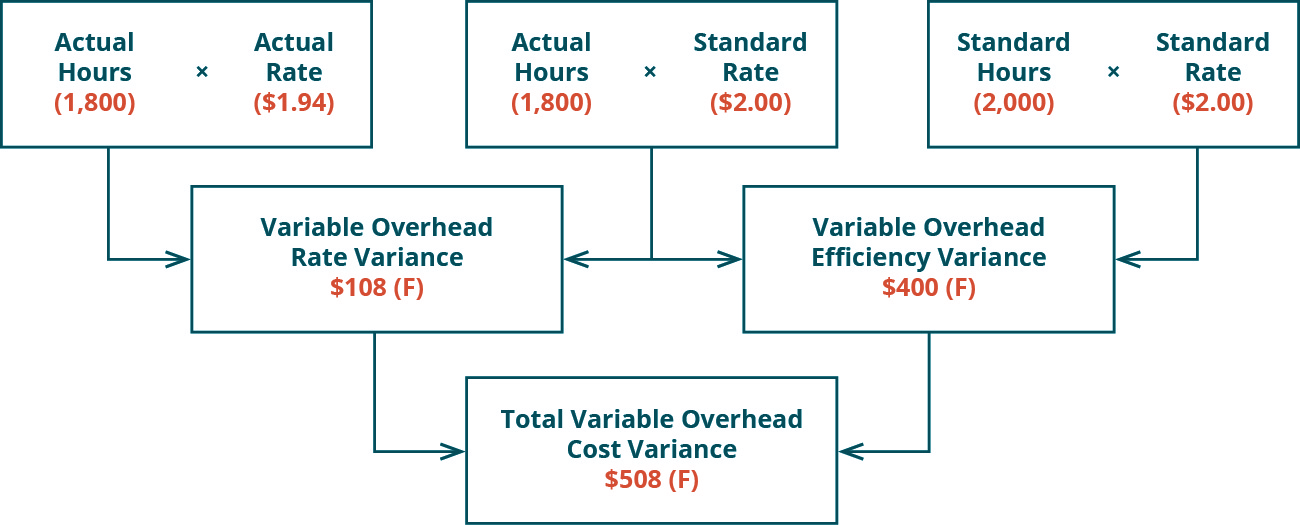

135 Standard overhead expense 260000 135000 395000 Variable overhead rate variance 210000 ADVERSE. Variable Overhead Spending variance Actual Rate Actual Hour - Standard Rate Actual Hour AH AR - SR Let plug in the formula. AH Actual hours worked during the period 69200.

Production was budgeted to be 12000 units. SR Standard variable manufacturing overhead rate 470. Therefore The total factory overhead cost variance is.

Standard price per ounce 178 Standard ounces per completed unit 12 Actual ounces purchased and used in production 13225 Actual price paid for materials 27111 Labor. With a selling price of 155 and a total production cost of 9360 the gross profit becomes 6140 per pair or a gross margin of 40 6140 divided by 155. Surfer Sam Company produced 4000 units of product that required 25 standard hours per unit.

Standard hourly labor rate 1412 per hour Standard hours allowed per. So Variance 728075 unfavorable. Determine the fixed factory overhead volume variance.

Actual fixed overhead was 360000 and actual variable overhead was 170000. Budgeted production 963 units Actual production 1070 units Materials. The actual data for the fiscal year ended 30 November 2018 are as follows.

Variable factory overhead controllable variance Actual variable factory overhead Budgeted variable factory overhead. Humo Company provided the following information. Now for calculation of VOCV we need to insert these values in our first formula.

Fixed overhead - 10 20000 divided by 2000 pairs Total production cost per pair - 9360. P 800 U D. P 500 U C.

And Actual variable overhead 67430. Variable overhead costs - 1360. Units produced 4400 Direct labor hours 8800 Variable overhead 29950 Fixed overhead 42300.

1701 728075. Actual production in units 198000. The standard costs and actual costs for factory overhead for the manufacture of 2500 units of actual production are as follows.

The variable factory overhead controllable variance is. The following data are given for Stringer Company. Standard overhead cost per unit 10125 Actual units produced 1800 Overhead allocated 182250 Actual overhead 132000 Difference between actual and allocated 50250 If actual overhead is less than allocated overhead then favorable else unfavorable Favorable A 107700 favorable B 107700 unfavorable C 50250 favorable D 50250 unfavorable Answer.

Factory Overhead Controllable Variance Formula. Budgeted fixed overhead P10000 Standard variable overhead 2 DLH at P2 per DLHP4 per unit Actual fixed overhead P10300 Actual variable overhead P19500 Budgeted volume 5000 units x 2 DLH 10000 DLH Actual direct labor hours DLH 9500 Units produced 4500 A. Direct labor hours per unit 5 Variable overhead per DLH.

Actual Variable Factory Overhead - Budgeted Variable Factory Overhead. AR 33575069200 48. Shi9 4000 Unfavorable Variance Fixed Factory Overhead Volume Variance Standard Hours for 100 of normal capacity Standard Hours for Actual Units Produced Fixed Factory Overhead Rate 14000 15000 600 6000 Favorable Variance Factory Overhead Cost Variance Variable Factory Overhead Controllable Variance Fixed Factory Overhead Volume.

Variable factory overhead 360000 Fixed factory overhead 104000 Standard hours allowed for units produced. Variable factory overhead controllable variance Standard hours for actual units produced Total factory overhead rate c. Standard variable overhead rate SVOR per direct labor hour407 Actual variable overhead costs.

The standard fixed overhead cost per unit is 080 per hour at 10500 hours which is 100 of normal capacity. Both fixed and variable overhead are allocated to the product on the basis of direct manufacturing labor-hours. The standard variable overhead is 335 17955 hours 6014925.

Standard direct labor hours for March 7000 Actual units produced in March 3000 Estimated variable manufacturing overhead for the year 140000 Estimated direct labor hours for the year 70000 Normal yearly capacity 30000 The amount of variable manufacturing overhead applied to Work-in-Process Inventory in March would be. Variable overhead spending variance 69200 485 - 470 1038000 U. Factory Overhead Volume Variance Formula.

Units produced 1 Direct labor hours 8 Variable overhead 6 Fixed overhead 17 Refer to Taylor Company. The variable overhead rate was 3 per hour. Actual variable overhead expense 185000.

Fixed Factory Overhead Rate Formula. But before that we need to find Standard Variable Overhead for Actual Production.

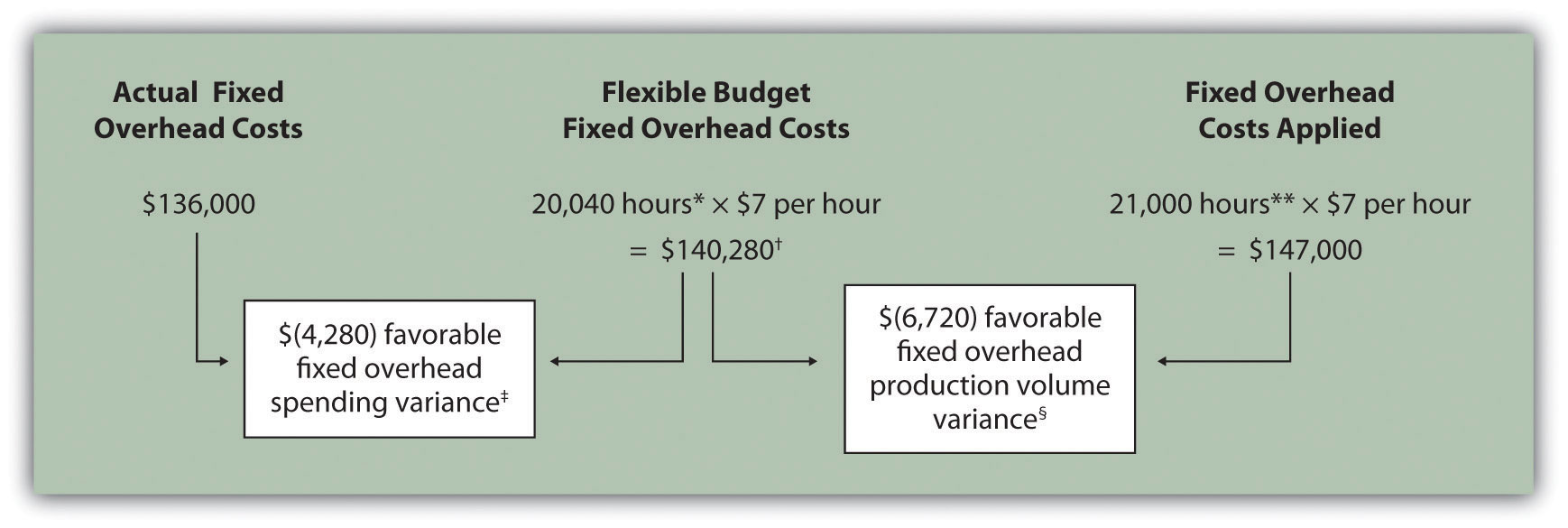

Fixed Manufacturing Overhead Variance Analysis

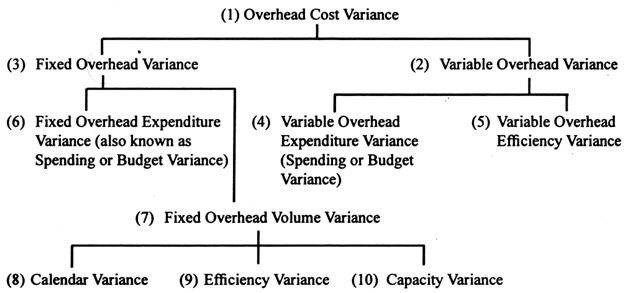

Overhead Variance Indiafreenotes

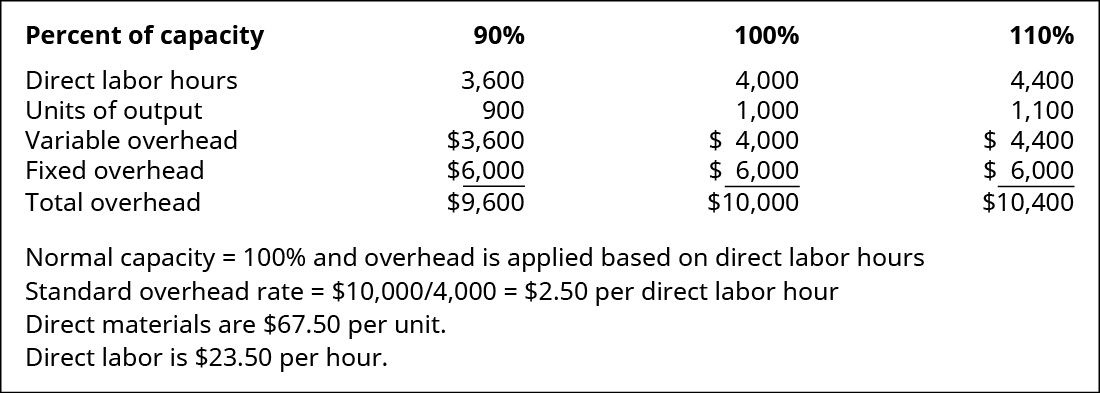

Standard Costing Variable Overhead Variances Cost Accounting Variables Overhead

Compute And Evaluate Overhead Variances Principles Of Accounting Volume 2 Managerial Accounting

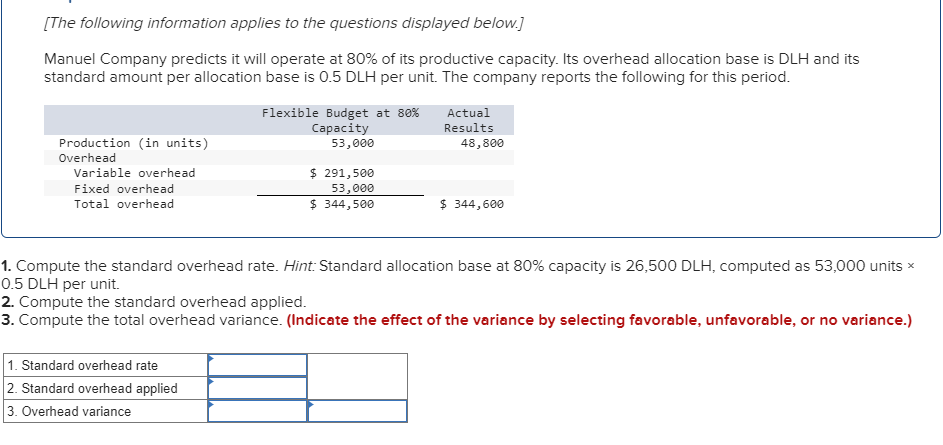

Solved The Following Information Applies To The Questions Chegg Com

Fixed Manufacturing Overhead Variance Analysis

Calculate Variable Overhead Efficiency Variance Accountinguide

Compute And Evaluate Overhead Variances Principles Of Accounting Volume 2 Managerial Accounting

Variable Overhead Efficiency Variance Formula

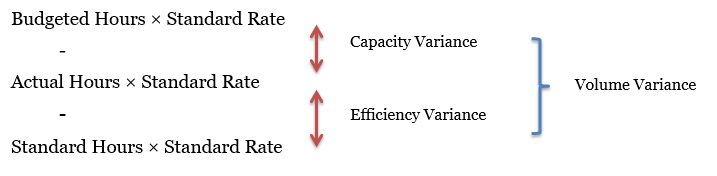

Fixed Overhead Volume Variance Capacity And Efficiency Variances Accounting Hub

Variable Manufacturing Overhead Variance Analysis Accounting For Managers

Standard Costing Overhead Variance Calculations And Journal Entries Cost Accounting Journal Entries Journal

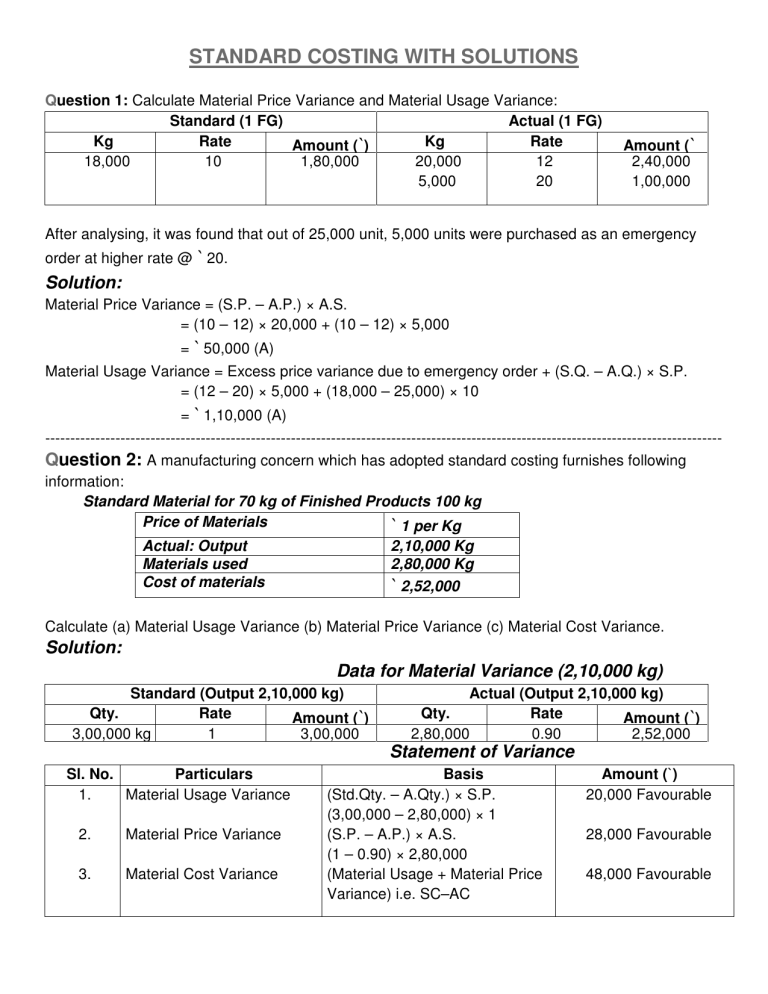

Standard Costing With Solutions

Fixed Manufacturing Overhead Variance Analysis

Standard Costing Overhead Variance Analysis Example Batch Level Cost Accounting Video Cost Accounting Accounting Analysis

Compute And Evaluate Overhead Variances Principles Of Accounting Volume 2 Managerial Accounting

10 8 Overhead Variances Financial And Managerial Accounting

Acc 350 Wk 9 Quiz 7 Chapter 8 All Possible Questions Quiz Chapter Chapter 3

Comments

Post a Comment